Key Takeaways

- Invoice finance and business loans differ in structure, suitability, and approval requirements.

- Invoice finance is often preferred for immediate cash flow needs and businesses growing rapidly.

- Business loans are better suited for long-term investments and large, one-time capital needs.

- Understanding the costs, benefits, and risk factors of each can help guide a sound financial decision.

Understanding Invoice Finance and Business Loans

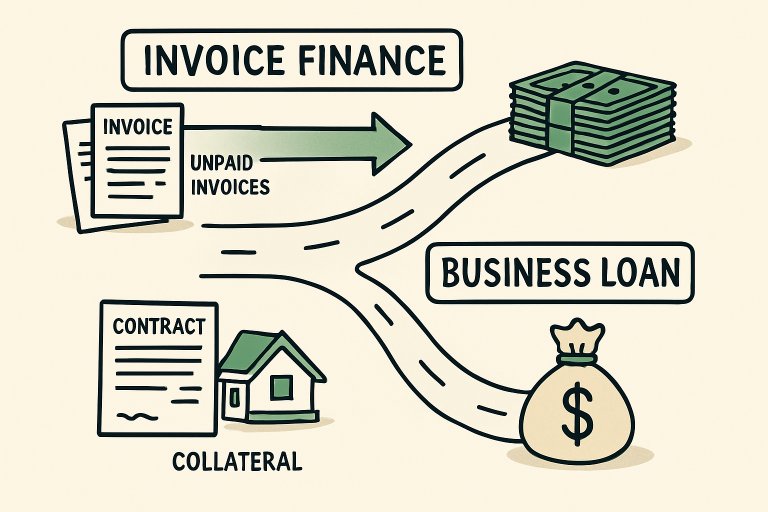

Managing cash flow is central to business health, yet many companies struggle with long payment terms or slow-paying customers. This challenge brings forward two popular financing options: invoice finance and business loans. What is invoice finance? In simple terms, it is a funding solution that allows businesses to unlock the cash in unpaid invoices by receiving an advance from a lender, often covering a significant percentage of the invoice value upfront. With invoice financing, businesses receive an immediate cash advance based on the value of their outstanding invoices, helping to bridge the gap between delivering goods or services and receiving payment. Business loans provide a lump sum repaid over a set term, usually with scheduled, fixed amounts plus interest.

Choosing these options depends heavily on your company’s cash flow cycles and overarching financial goals. Invoice finance offers a revolving line of credit tied to your accounts receivable, making it ideal for smoothing short-term cash flow. Meanwhile, business loans, often issued by banks or financial institutions, provide certainty and flexibility for larger, longer-term investments. Understanding the nuances of each can help business owners avoid unnecessary debt burdens and optimize working capital management.

Key Differences Between Invoice Finance and Business Loans

- Approval Process: Invoice finance approvals are typically faster, focusing on the credit quality of your customers rather than your own business history. This makes it an attractive option for companies with limited or evolving credit profiles.

- Repayment Structure: With invoice finance, funds are repaid as your customers settle their invoices, which naturally aligns with your receivables cycle. Business loans, conversely, require fixed monthly repayments, potentially placing strain on businesses during slow sales periods or seasonal downturns.

- Collateral Requirements: Invoice finance uses invoices themselves as security, often with no other collateral needed. Traditional business loans, however, may demand tangible assets such as property or equipment as additional security.

Understanding these differences can help guide your business toward the most suitable financing method.

When to Choose Invoice Finance Over a Business Loan

Businesses might find invoice finance a superior choice in scenarios where cash flow is a bottleneck due to slow customer payments, or where a lack of working capital otherwise constrains rapid expansion. Specifically, invoice finance becomes attractive when:

- Immediate Cash Flow Needs: Companies with significant amounts in unpaid invoices can use invoice finance to release funds quickly, ensuring smooth operational continuity, paying suppliers, or covering payroll.

- Rapid Growth: As sales surge, so do outstanding invoices. Invoice finance grows in line with sales, automatically scaling up funding to support larger purchase orders and expansion plans.

- Limited Credit History: Start-ups or younger businesses that might not meet the strict lending requirements for traditional loans can access invoice finance based on the creditworthiness of their customers, not themselves.

These features reduce stress during periods of aggressive growth or unexpected financial hurdles, making invoice finance a favored tool among fast-scaling businesses.

When a Business Loan Might Be More Appropriate

Business loans shine when your long-term financing needs require larger sums for specific projects, such as equipment purchases, real estate acquisitions, or business expansions not directly tied to the accounts receivable process. Consider a traditional loan if:

- Long-Term Investments: Major capital projects require time to generate returns, making fixed, scheduled repayments preferable to revolving, sales-tied finance options.

- Fixed Funding Requirements: If you know exactly how much capital you need—for example, to buy a new delivery vehicle—a business loan delivers that up front with clear repayment terms.

- Established Credit Profile: Established businesses with robust credit scores often qualify for more favorable rates and flexible terms, bringing down the overall cost of borrowing.

Business loans are most beneficial when you need predictable costs and clear, long-term repayment horizons.

Evaluating Costs and Benefits

Comparing finance options involves more than headline rates. Invoice finance providers typically charge a fee as a percentage of the invoice value, and costs can vary based on invoice amounts, customer risk profiles, and volumes. Some also charge arrangement or ongoing management fees. Business loans, meanwhile, come with set interest rates, possible origination fees, and, occasionally, prepayment penalties for early settlement.

Consider how flexible funding structures, potential costs, and risks fit your company’s financial profile and growth plans when weighing choices. It’s worth using online calculators or consulting with a specialist to model scenarios and forecast the real cost of each finance type over time.

Final Thoughts

Invoice finance and traditional business loans each have distinct advantages, and the ideal choice depends on your business’s current needs, operational risks, and future growth objectives. Invoice finance delivers speed and scalability, supporting businesses through short-term cash shortages and helping those in rapid growth phases. A business loan may be preferable for long-term investments or when fixed funding amounts are needed and reliable revenue streams support scheduled repayments. Evaluate your needs, consider the costs and future impact on cash flows, and consult external resources to make the soundest financial decision for your business’s specific situation.

Leave a Reply